So, how much should we tax the rich? 70%? 90%?

We do not need new revenue. We need to drastically reduce military spending.

I favor increasing the tax burden on the wealthiest in order to reduce the tax burden on the least wealthy. The latter will then have more money to spend which will increase the income of, among others, the wealthiest.

STANV said:

We do not need new revenue. We need to drastically reduce military spending.

I favor increasing the tax burden on the wealthiest in order to reduce the tax burden on the least wealthy. The latter will then have more money to spend which will increase the income of, among others, the wealthiest.

I partially agree that the need for a higher tax rate on the wealthy is only partly about raising new revenue, but is also aimed at decreasing wealth concentration.

But rather than decreasing tax burdens, I think the revenue should be used for providing more government support for health care, education, child care, etc.

I don't think, at the federal level, the need for decreasing tax rates for the bottom 90% is a priority. Already, 45% don't pay federal income taxes, though they still pay substantial SS taxes, which is a different subject. We should alter or remove the cap on SS taxes, both to shore up SS and to lower the SS tax rates for lower income Americans.

It's hard to talk about isolated tax issues. They're all connected.

The problem is that the whole system of taxation, at all levels of government, has gotten screwed up due to the constant lowering of tax rates at the federal level. There are many parts to fix.

A recent poll shows a 70% rate is supported by 59% of America.

STANV said:

We do not need new revenue. We need to drastically reduce military spending.

I favor increasing the tax burden on the wealthiest in order to reduce the tax burden on the least wealthy. The latter will then have more money to spend which will increase the income of, among others, the wealthiest.

Can you just explain this in terms of revenue and spending?

basil said:

I am confused. Are we debating whether or not we need any new tax revenue to begin with? Or are we accepting that we need new revenue and are now trying to figure out how much this progressive tax would produce? Or are we debating how we are going to use this new revenue?

Because these all seem separate (albeit related) discussions to me.

I agree these are separate questions and that it's worth calling this out. I'd also add a fourth -- how is the tax burden distributed

Not to derail, but this confusion always bugs me when talking local taxes. Here in NJ people complain that taxes are too high. I actually disagree -- I think they are distributed wrong, and so some people pay too much -- but others pay too little. I don't know that "taxes" overall are too high -- at least, not to the point that we could reduce spending enough that the average resident would realize a significant decrease in their taxes.

On the national level, though, there's definitely things I think we should be spending more on (such as our mass transit infrastructure, transitioning our energy to renewable, and our health and welfare systems), and I'm not sure reducing military spending would offset that sufficiently. So yes, we need more revenue, but also we need to change the way we collect it to be less burdensome.

Hopefully Sandy from the Bronx (by way of Yorktown Heights, Westchester County) proposes making insider trading restrictions applicable to members of Congress as well. Assuming she knows what insider trading is.

Robert_Casotto said:

Hopefully Sandy from the Bronx (by way of Yorktown Heights, Westchester County) proposes making insider trading restrictions applicable to members of Congress as well. Assuming she knows what insider trading is.

I love that she makes you guys crazy.

Talk about owning the libs...

AOC completely owns the cons. And it will be to her advantage that they assume she's stupid. Nothing better than being underestimated.

Robert_Casotto said:

Hopefully Sandy from the Bronx (by way of Yorktown Heights, Westchester County) proposes making insider trading restrictions applicable to members of Congress as well. Assuming she knows what insider trading is.

Given that Ocasio-Cortez is a United States representative, and you're a random name on a community message board, if I had to assume only one of you knows what insider trading is, I'm going to have to go with the US rep.

There are quite a few problems with this tax plan, even if you ignore the moral issues involved.

First, you're not going to get $70 Billion. That number seems to assume that no adjustments will be made. Remember, that the tax is going to be 70% at the federal level. In many states and municipalities, this means that this income will be taxed well over 80% and could approach 90%. I believe in NYC, this would amount to an 86% tax on income over the threshold.

Literally, no company is going to compensate their employees at a tax rate like that. They will adjust. They will compensate in ways that are not subject to the tax. This would act very similarly to the WWII wage caps...which is how your health insurance and then health services got tethered to your employment in the first place.

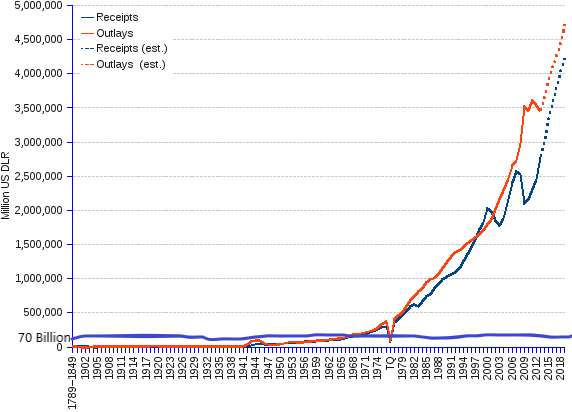

But let's say nobody adjusted. $70 Billion is NOTHING(see chart to put it in perspective). Therefore, anyone who see's this as a revenue generator is ignorant of the facts.

This will not pay for any of the things that drummerboy proposes. To pay for those kinds of things you want in the Scandanavian countries, you are going to have to pay taxes at rates AOC proposes. In those countries the top tax rates kick in much lower(say $60,0000 a year). In addition, they have VAT taxes, etc. And you could forget about further reducing the tax burden of those on "the bottom".

AOC may be smart, but at best she's selling a fairy tale to a bunch of rubes.

terp said:

There are quite a few problems with this tax plan, even if you ignore the moral issues involved.

First, you're not going to get $70 Billion. That number seems to assume that no adjustments will be made. Remember, that the tax is going to be 70% at the federal level. In many states and municipalities, this means that this income will be taxed well over 80% and could approach 90%. I believe in NYC, this would amount to an 86% tax on income over the threshold.

Literally, no company is going to compensate their employees at a tax rate like that. They will adjust. They will compensate in ways that are not subject to the tax. This would act very similarly to the WWII wage caps...which is how your health insurance and then health services got tethered to your employment in the first place.

But let's say nobody adjusted. $70 Billion is NOTHING(see chart to put it in perspective). Therefore, anyone who see's this as a revenue generator is ignorant of the facts.

This will not pay for any of the things that drummerboy proposes. To pay for those kinds of things you want in the Scandanavian countries, you are going to have to pay taxes at rates AOC proposes. In those countries the top tax rates kick in much lower(say $60,0000 a year). In addition, they have VAT taxes, etc. And you could forget about further reducing the tax burden of those on "the bottom".

AOC may be smart, but at best she's selling a fairy tale to a bunch of rubes.

You sound like tony soprano saying:

1) we should have no criminal law because criminals are not going to follow the law anyway,

2) even if they are going to follow the law, there aren't really that many criminals anyway

What I'm saying is that paying for socialist programs or reducing the deficit in a real way is not a reason to like this law.

There are 2 reasons to like this law:

1)ignorance

2)resentment of the rich

Essentially, this is the democratic socialist version of Trump's wall.

terp said:

What I'm saying is that paying for socialist programs or reducing the deficit in a real way is not a reason to like this law.

There are 2 reasons to like this law:

1)ignorance

2)resentment of the rich

Essentially, this is the democratic socialist version of Trump's wall.

gah - you're missing the forest for the trees.

It's not about 70 billion a year, or whatever the number for this particular tweak is.

It's about changing the conversation and moving us in a direction away from unqualified and destructive policy support for the wealthy and corporations.

terp said:

What I'm saying is that paying for socialist programs or reducing the deficit in a real way is not a reason to like this law.

There are 2 reasons to like this law:

1)ignorance

2)resentment of the rich

Essentially, this is the democratic socialist version of Trump's wall.

you have a tendency to assume people you don't agree with are either stupid or venal. It's why I'm reluctant to engage.

But those aren't the only two alternatives. There is a case made by some economists (I have to assume they aren't ignorant) for higher marginal tax rates on the upper income earners. The theory is that lowering taxes on the wealthiest drove extreme income inequality. And a lot of people think that's not good for a society overall -- not because they hate the rich.

We don't have to agree. But that doesn't mean we should assume the other person is a stupid, resentful rube.

https://www.theguardian.com/commentisfree/2013/oct/24/1percent-pay-tax-rate-80percent

terp said:

What I'm saying is that paying for socialist programs or reducing the deficit in a real way is not a reason to like this law.

There are 2 reasons to like this law:

1)ignorance

2)resentment of the rich

Essentially, this is the democratic socialist version of Trump's wall.

You gave reason #3 in an earlier post:

"Literally, no company is going to compensate their employees at a tax rate like that. They will adjust. They will compensate in ways that are not subject to the tax. This would act very similarly to the WWII wage caps...which is how your health insurance and then health services got tethered to your employment in the first place. "

Wage caps were a different animal. In a tight wartime labor market extreme measures were necessary. A large percentage of the work force was otherwise occupied. And we're not talking about wage caps for the regular workforce anyway.

Otherwise, exactly right. In the period after WWII when there were no wage caps and marginal rates were extremely high, companies adjusted. And the way they adjusted was by giving higher salaries to regular workers. That's the "reducing income inequality" rationale for this proposal. Extreme income inequality is bad for society, and often leads to violence.

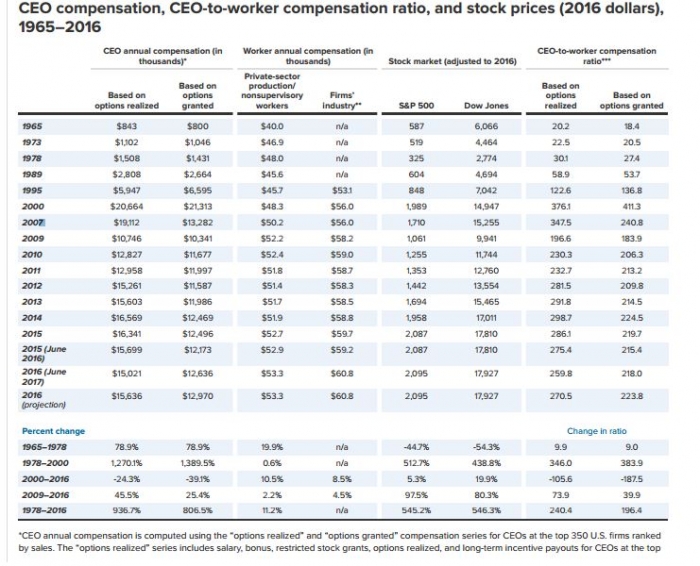

Here's a chart from CNBC:

This widening gap is a direct consequence of tax policy. As you correctly infer. If a company will not pay that level of compensation when the marginal rate is increased, it follows that a company will pay that level when the marginal rate is lowered.

And wouldn't you know it, between 1978 and 1989 CEO pay nearly doubled, while non-executive pay decreased.

These results are a product of governmental policies, not random fluctuations in a free market. And the government could have chosen other policies. It's not an "invisible hand" scenario.

So we have to examine whether or not these policies have proven to be good for the population at-large, or whether other policies would have benefited the country more.

The current tax regime resulting in a 250:1 ratio of pay is not useful or beneficial.

Only thing that really matters when it comes to tax policy. Can you or can you not make a mean caipirinha.

ml1 said:

terp said:you have a tendency to assume people you don't agree with are either stupid or venal. It's why I'm reluctant to engage.

What I'm saying is that paying for socialist programs or reducing the deficit in a real way is not a reason to like this law.

There are 2 reasons to like this law:

1)ignorance

2)resentment of the rich

Essentially, this is the democratic socialist version of Trump's wall.

But those aren't the only two alternatives. There is a case made by some economists (I have to assume they aren't ignorant) for higher marginal tax rates on the upper income earners. The theory is that lowering taxes on the wealthiest drove extreme income inequality. And a lot of people think that's not good for a society overall -- not because they hate the rich.

We don't have to agree. But that doesn't mean we should assume the other person is a stupid, resentful rube.

https://www.theguardian.com/commentisfree/2013/oct/24/1percent-pay-tax-rate-80percent

You're really sensitive. Most of the commentary of this political soapbox are how the people on their right are evil and "bat **** crazy". You don't seem to take much issue with that.

Regarding the argument the tax policy drove income inequality. I think it's an empty argument. We are just now winding down policies that included a quasi government agency conjuring trillions of $$ out of thin air and giving it to insolvent financial institutions after many working class Americans lost everything. That phenomenon has quite a bit to do with income inequality in this country. Much more so than any tax policy that people will find their way around.

How much is Warren Buffet going to get taxed? The man earns a salary of $100K. He has engineered his finances to avoid taxes, but argues for higher taxes on wage earners to great praise. These people make the rules.

Is there rent seeking by the top in this country? You bet there is. But that is not going to be solved via this tax policy. If you want people to stop rent seeking, you have to shrink the government. Rent seeking is literally why our government does most of what it does. For example, do you think the military industrial complex players care about winning a war? No. Success means profits.

I think that largely addresses tom's post as well. I will only add that tax policy is not the only factor that affects compensation. As we've become more global, the heads of these large organizations have much more of a global reach/impact than ever before. They drive a lot more productivity than at any time in history.

All through history resources tend to follow a pareto distribution. The 20th Century is replete with examples of people trying to reverse this natural state. These have typically resulted in both the same distribution and in disaster.

Anyhoo, while I do have concerns about rent seeking, I don't think this tax policy is going to help that situation much. And for those that gained extreme wealth in the free market, I have nothing but congratulations for them. Because, if they did this in the free market, you can bet that society benefited many times over the wealth they accumulated(see Steve Jobs).

The only reason I would begrudge someone who earned their wealth honestly some of that wealth is because I have resentment. I don't see any other way. Why do I care if a basketballs star, a CEO, a rock star, has 1 yacht or 50? I don't see why anyone would spend a second thinking about it. If they are going to lobby government to limit my freedom, I see that as a problem with my government.

terp said:

You're really sensitive. Most of the commentary of this political soapbox are how the people on their right are evil and "bat **** crazy". You don't seem to take much issue with that.

I'm not particularly sensitive. I just know that if you and I exchange more than a few responses, at some point you'll tell me I'm being stupid.

terp said:

ml1 said:

terp said:

Anyhoo, while I do have concerns about rent seeking, I don't think this tax policy is going to help that situation much. And for those that gained extreme wealth in the free market, I have nothing but congratulations for them. Because, if they did this in the free market, you can bet that society benefited many times over the wealth they accumulated(see Steve Jobs).

The only reason I would begrudge someone who earned their wealth honestly some of that wealth is because I have resentment. I don't see any other way. Why do I care if a basketballs star, a CEO, a rock star, has 1 yacht or 50? I don't see why anyone would spend a second thinking about it. If they are going to lobby government to limit my freedom, I see that as a problem with my government.

First you have to reconsider the proposition that society has benefitted many times over from one a typical achiever who gained extreme wealth in the free market. Surely Steve Jobs did, but tell me about all these hedge fund guys who are making 10's/100's/1000's of millions? For example how exactly did society benefit from the guys who profited from the disintegration of Toys R Us or Sears?

Neither do I care if someone has 1 yacht or 50. What I do care about is that this person Is probably not satisfied with 50, and has the resources to game the system in order to procure his 51st.

Red_Barchetta said:

terp said:First you have to reconsider the proposition that society has benefitted many times over from one a typical achiever who gained extreme wealth in the free market. Surely Steve Jobs did, but tell me about all these hedge fund guys who are making 10's/100's/1000's of millions? For example how exactly did society benefit from the guys who profited from the disintegration of Toys R Us or Sears?

ml1 said:

terp said:

Anyhoo, while I do have concerns about rent seeking, I don't think this tax policy is going to help that situation much. And for those that gained extreme wealth in the free market, I have nothing but congratulations for them. Because, if they did this in the free market, you can bet that society benefited many times over the wealth they accumulated(see Steve Jobs).

The only reason I would begrudge someone who earned their wealth honestly some of that wealth is because I have resentment. I don't see any other way. Why do I care if a basketballs star, a CEO, a rock star, has 1 yacht or 50? I don't see why anyone would spend a second thinking about it. If they are going to lobby government to limit my freedom, I see that as a problem with my government.

Neither do I care if someone has 1 yacht or 50. What I do care about is that this person Is probably not satisfied with 50, and has the resources to game the system in order to procure his 51st.

You can include most of the financial industry among those who are of no benefit to society as a whole.

terp said:

This will not pay for any of the things that drummerboy proposes. To pay for those kinds of things you want in the Scandanavian countries, you are going to have to pay taxes at rates AOC proposes. In those countries the top tax rates kick in much lower(say $60,0000 a year). In addition, they have VAT taxes, etc. And you could forget about further reducing the tax burden of those on "the bottom".

I've been to Sweden. Know a bunch of Swedes. Nice country, nice people. Apart from the half year of darkness (which, contrary to some claims is a result of latitude, not economics), it seems to have a really great quality of life. I'm not really following how an affluent, successful country is supposed to serve as a cautionary tale.

PVW said:

I'm not really following how an affluent, successful country is supposed to serve as a cautionary tale.

[Insert Ikea assembly joke here.]

DaveSchmidt said:

PVW said:[Insert Ikea assembly joke here.]

I'm not really following how an affluent, successful country is supposed to serve as a cautionary tale.

I would, but I can't find the stupid tool that lets me unscrew the whatsit to attach the other thing.

terp said:

And for those that gained extreme wealth in the free market, I have nothing but congratulations for them. Because, if they did this in the free market, you can bet that society benefited many times over the wealth they accumulated(see Steve Jobs).

That is a fairly random statement that is not based on any fact

basil said:

terp said:That is a fairly random statement that is not based on any fact

And for those that gained extreme wealth in the free market, I have nothing but congratulations for them. Because, if they did this in the free market, you can bet that society benefited many times over the wealth they accumulated(see Steve Jobs).

It's based on something better than fact - a blinding faith in The Invisible Hand of the market.

Robert_Casotto said:

Only thing that really matters when it comes to tax policy. Can you or can you not make a mean caipirinha.

If you can take a break from your middle-school bully grade postings, read this:

I am somewhat bemused, I suppose is the best term, by AOC, but I also believe that younger Americans are more closely aligned with her views than are the failed old people currently mis-running the country.

basil said:

terp said:That is a fairly random statement that is not based on any fact

And for those that gained extreme wealth in the free market, I have nothing but congratulations for them. Because, if they did this in the free market, you can bet that society benefited many times over the wealth they accumulated(see Steve Jobs).

It's really not. But there is a lot of confusion about what the free market is. There is no pure free market.

There are 2 forces that drive human exchange. First, there is the free market. This is simply, individuals exchanging goods and services with one another as they see fit. The other force are exchanges that are compelled by government intervention and coercion.

Typically, our systems exist in a continuum between these 2 forces. Many people on this board argue to move along that continuum towards more government intervention and coercion. I, quite obviously, tend to argue towards free exchange.

In a system dominated by free exchange, when people trade it is mutually beneficial to both parties. That is, both parties win when an exchange takes place. When you go to your grocer and buy loaf of bread for $3, you are happy because you value that loaf of bread at more than $3. The grocer is happy because they value the $3 more than the loaf of bread.

Thus, anyone who gets rich making these kinds of exchanges has brought quite a bit of value to others in society.

I'll leave it to you to determine how you get rich in a society dominated by government intervention and coercion.

PVW said:

terp said:I've been to Sweden. Know a bunch of Swedes. Nice country, nice people. Apart from the half year of darkness (which, contrary to some claims is a result of latitude, not economics), it seems to have a really great quality of life. I'm not really following how an affluent, successful country is supposed to serve as a cautionary tale.

This will not pay for any of the things that drummerboy proposes. To pay for those kinds of things you want in the Scandanavian countries, you are going to have to pay taxes at rates AOC proposes. In those countries the top tax rates kick in much lower(say $60,0000 a year). In addition, they have VAT taxes, etc. And you could forget about further reducing the tax burden of those on "the bottom".

I was speaking of the tax rates. I don't see people here volunteering to pay a 60+% of everything they earn over $60K per year.

But since you know so many Swedes, I must ask. Did they speak to you about their minimum wage laws? Did they tell you about their school voucher program? Did they share their corporate tax rates with you? Did they share the Swedish history of free exchange prior to the construction of their welfare state that resulted in a tenfold increase in the standard of living establishing them as the 4th richest country in the nation?

Did they share with you how the establishment of the welfare state in the 1960's and 1970's has caused them to start falling down the list of wealthiest nations? Did they tell you about all the currency devaluations that caused them to start to roll back some of the welfare state in the 1990's

One of the most vapid arguments that people on the left seem to make is that we can simply map a specific policy they prefer from another country to the United States and it will work exactly as it does there.

terp said:

Did they share with you how the establishment of the welfare state in the 1960's and 1970's has caused them to start falling down the list of wealthiest nations? Did they tell you about all the currency devaluations that caused them to start to roll back some of the welfare state in the 1990's.

Is that cause and effect or is it because of the rise of Asian nations, for example? You have to admit that the relative wealth of the West was a bit of an aberration attributable to the West getting a lead on the rest of the world.

Featured Events

-

Stephen Whitty Presents - Hometown Movie Stars: The Celebrated Actors Of CHS

May 6, 2024 at 7:00pm

-

'Beethoven's Wrong Note: A Steampunk Opera'

May 12, 2024 at 2:00pm

For Sale

Garage Sales

-

HUGE Rummage sale to benefit the Bloomfield High School Robotics Team Sale Date: Apr 27, 2024

More info

all of the above