So, how much should we tax the rich? 70%? 90%?

kthnry said: You should have heard all the troglodytes here in Texas accusing Beto, an Anglo who uses his childhood nickname, of trying to pass as Hispanic to get the Hispanic vote. As if that would be a wining strategy in a red state like Texas (or anywhere, for that matter). And (gasp!) he used his real name (Robert) for a few years when attending Columbia. They were so proud of their sick burn.

Of course, his opponent, Rafael Cruz, is a Hispanic using an Anglo nickname (Ted), which is the more common scenario, but that's not a problem.

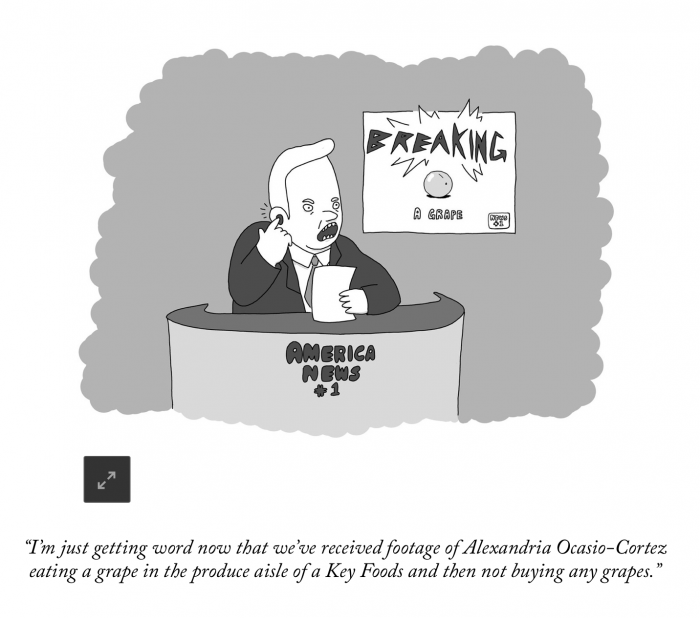

Meanwhile,

The "where should we draw the line?" question is stupid, because it seems to imply that since it's a subject of debate, we can't all agree on a line, so there shouldn't be a line. Of course there should be a line.

terp and Tom_R, here is the wikipedia article on progressive taxation.

drummerboy said:

Doesn't anglo simply mean white and non-hispanic these days?

That's how it's always been used in Texas. There's no association with a country of origin.

Yes, Beto is of Irish descent. But it's not unusual to pick up a Spanish nickname in a city that is 80% Hispanic.

The National Hero of Chile is O'Higgins.

The first President of the Republic of Ireland was de Valera.

The sixth President of Israel was Irish.

First guy to tell an Irishman that he’s an Anglo gets a shiny fiver.

Robert_Casotto said:

First guy to tell an Irishman that he’s an Anglo gets a shiny fiver.

do you really not know what "Anglo" means in relation to Latin Americans? Or are you making an attempt at "humor"?

an incorrect generality based solely on immutable physical characteristics. thats called racism.

Robert_Casotto said:

an incorrect generality based solely on immutable physical characteristics. thats called racism.

it's based on language spoken.

are you really not understanding this concept, or are you being obtuse in order to troll?

Yankee

(chiefly outside USA) A native or inhabitant of the United States.

(chiefly Southern USA) A native or inhabitant of the Northern United States.

(chiefly Northern USA) A native or inhabitant of New England.

and if you go further back, a Yankee would be a Dutch settler.

So definitions change and it isn't racist or anything else.

drummerboy said:

um, so what about them tax rates, huh?

And them Mets!

Well, as some have argued here before, there is nothing wrong with progressive tax rates/brackets. For one thing it works very well against income inequality. In fact the current US tax system is still a progressive system, but it has been hollowed out by conservatives, and voila: income inequality (which is probably the biggest internal issue we have in this country, and it also helped fuel the feelings of unfairness that got Trump elected and that Bernie tapped into). And it's not just marginal tax rates, but also other taxes that are meant to make sure that all wealth doesn't get concentrated in the top 1% of our society (estate/inheritance tax for example).

So for brackets >$5m or >$10m a year, marginal tax rates of 70%-90%? Heck yes! This argument that some CEO that makes $10m a year somehow is not motivated anymore to work harder for a raise to $11m a year is a pretty lame argument.

But! We also already know that the super-rich have so many tax loopholes that they probably pay less taxes than common folks, so in addition to higher marginal tax rates we also need to close all these loopholes.

All this conservative talk of how this will kill the economy, while the economy will only grow if you cut taxes is not grounded in any facts.

Angles are about as Celtic (and vice versa) as Yankees are Mets.

drummerboy said:

Doesn't anglo simply mean white and non-hispanic these days?

I assumed that was the general term...but not sure it includes Southern European ancestry.

Robert_Casotto said:

First guy to tell an Irishman that he’s an Anglo gets a shiny fiver.

That was not the response of a Jew to being called a "damned Gentile".

https://en.wikipedia.org/wiki/Simon_Bamberger#Political_ascent

Being Jewish, as it turned out, was not a fatal handicap for Bamberger, but at first wasn't exactly an asset, either. An anti-Semitic flyer bearing a caricature depicting Bamberger with an exaggerated large nose circulated widely, although eventually a majority of leading citizens publicly condemned it. Then the tide turned in Bamberger's favor, thanks in no small degree to his wit and humor. When making a campaign stop at a community of Norwegian immigrants who had converted to Mormonism, Bamberger initially encountered some resistance from the town's leader, who declared that the community wouldn't deign to consider any "damned Gentile." (At the time, some Mormons referred to all non-Mormons as "Gentiles," regardless of their religion. See Mormonism and Judaism for more details.) Without missing a beat, Bamberger answered, "As a Jew, I've been called many a bad name, but this is the first time in my life that I've been called a 'damned Gentile'!" The Norwegian Mormons then embraced Bamberger, declaring him to be an "Israelite."[citation needed] This way of perceiving Bamberger began to spread statewide, putting anti-Semitism out of the equation altogether

GL2 said:

drummerboy said:I assumed that was the general term...but not sure it includes Southern European ancestry.

Doesn't anglo simply mean white and non-hispanic these days?

ya mean I'm not Anglo?

well I'll be...

Tom_Reingold said:

The "where should we draw the line?" question is stupid, because it seems to imply that since it's a subject of debate, we can't all agree on a line, so there shouldn't be a line. Of course there should be a line.

terp and Tom_R, here is the wikipedia article on progressive taxation.

This post is stupid and presumptuous. I know where the line is when I am talking to someone who argues for confiscatory tax rates. Those rates inevitably start at compensation levels that person thinks they will never reach.

My next question: what problems will this new tax regime solve and how?

terp said:

Tom_Reingold said:This post is stupid and presumptuous. I know where the line is when I am talking to someone who argues for confiscatory tax rates. Those rates inevitably start at compensation levels that person thinks they will never reach.

The "where should we draw the line?" question is stupid, because it seems to imply that since it's a subject of debate, we can't all agree on a line, so there shouldn't be a line. Of course there should be a line.

terp and Tom_R, here is the wikipedia article on progressive taxation.

My next question: what problems will this new tax regime solve and how?

We'd have the money to pay for nice things. See my earlier post.

drummerboy said:

terp said:We'd have the money to pay for nice things. See my earlier post.

Tom_Reingold said:This post is stupid and presumptuous. I know where the line is when I am talking to someone who argues for confiscatory tax rates. Those rates inevitably start at compensation levels that person thinks they will never reach.

The "where should we draw the line?" question is stupid, because it seems to imply that since it's a subject of debate, we can't all agree on a line, so there shouldn't be a line. Of course there should be a line.

terp and Tom_R, here is the wikipedia article on progressive taxation.

My next question: what problems will this new tax regime solve and how?

Is this based on any calculations? How much revenue do you expect to generate from this tax? How much will the smorgasbord of programs you outlined earlier cost?

I'm not interested in an argument, but I thought I'd just add a couple of comments. The estimates of the amount of revenue that a 70% tax on incomes over $10MM a year are around $70bn. (http://time.com/money/5495760/alexandria-ocasio-cortez-70-percent-tax-rate-rich/) It's not a huge amount, but it's also not nothing. If the U.S. was really serious about a Green New Deal, you could get most of the way to financing it with that income tax on high earners, a carbon tax, repeal of the 2017 tax cut, and a 1/3 cut to the military budget. But I doubt that there's the political will to do any of it (except perhaps undoing the tax cut which has turned out to be fairly unpopular overall).

And there's a rationale for increasing taxes on very high earners, and it's not because most people will never see that kind of dough. It's because the marginal utility of a dollar earned at those levels is a lot less than dollars earned around the median income for example.

In terms of increasing revenue for nice things - the recent tax cut should absolutely be repealed. Just cancel the whole damn thing. And I'm upset that no Democrat seems to be saying that this is a goal.

terp said:

drummerboy said:Is this based on any calculations? How much revenue do you expect to generate from this tax? How much will the smorgasbord of programs you outlined earlier cost?

terp said:We'd have the money to pay for nice things. See my earlier post.

Tom_Reingold said:This post is stupid and presumptuous. I know where the line is when I am talking to someone who argues for confiscatory tax rates. Those rates inevitably start at compensation levels that person thinks they will never reach.

The "where should we draw the line?" question is stupid, because it seems to imply that since it's a subject of debate, we can't all agree on a line, so there shouldn't be a line. Of course there should be a line.

terp and Tom_R, here is the wikipedia article on progressive taxation.

My next question: what problems will this new tax regime solve and how?

The point is that the money can be used to provide some of those things. The U.S. needs to move from policies that favor the wealthy and corporations to ones that favor services for average people. The only way to do that is to start changing and re-allocating our revenue sources. This is a first step. It's not the whole solution.

terp said:

My next question: what problems will this new tax regime solve and how?

It would reduce the deficit.

I am confused. Are we debating whether or not we need any new tax revenue to begin with? Or are we accepting that we need new revenue and are now trying to figure out how much this progressive tax would produce? Or are we debating how we are going to use this new revenue?

Because these all seem separate (albeit related) discussions to me.

For Sale

Garage Sales

-

Multi Family Garage Sale Sale Date: Apr 20, 2024

More info

you know, I've been thinking about how to respond to his post. I don't have much desire to answer in specifics, to be honest.

I think the questions you pose display a shortsighted view of taxes in America, especially vis a vis the rest of the developed world.

To answer one of your questions:No - we shouldn't all pay more, because everyday folk pay too much already.

Things that other modern nations expect as part of their government services, we pay for out of pocket:

and so on.

These are costs that other nations have rightfully deemed to be shared and spread out across society. We, on the other hand, pretend that the "market" is the best way to handle these costs, so they are borne by the individual - further insuring the upward movement of wealth. These are as much "taxes" as the actual taxes we pay. So yeah, but thank you very much, the average American is paying these "taxes" through the nose already.

I may deal with other parts of your post later.