I can't believe my property taxes

sac said:

PVW said:Amen!

I always feel like these discussion conflate what are actually two separate questions -- how much should taxes be, and how should the tax burden be distributed. The latter, I think, is more relevant on property tax questions. As @spontaneous noted, property taxes are basically about "how much house you could afford at one single point in your life."

Given the general political lean of the area, I think most here would agree that tax payments should be tied to ability to pay, and so the idea of deciding your tax burden for a decade or two based on the circumstances of a single year feels unfair.

But then the argument generally takes a turn, to "how much" rather than "how to distribute." And my take on this is that this is an example of how wealth defends and consolidates itself, because all of a sudden we're talking about pension funds and "wasteful" municipal services. But ask yourself, where do all these folks benefitting from all this waste live? Not in SOMA. They're living in Union or Perth Amboy or even further afield. Fine towns I'm sure, though I'll note none of us chose them. Yet somehow they're the beneficiaries of our unbelievably high taxes?

If I were dictator of NJ, I'd scrap the property tax and go all in on income-based taxes, and add a lot more brackets at a much higher rate on the high end. Most people would have the same or lower overall taxes, but a few people would have much, much higher overall taxes.

And I'd argue that this is precisely why such a proposal is never seriously considered, because the interests of those few are so deeply embedded into the system that it's almost inconceivable to directly challenge it. Much easier to argue about how much we should cut the DPW budget by, or if we can get away with reneging on pension obligations.

(And I would likely pay more under that system than I do now, so don't even start with me on that line of argument.)

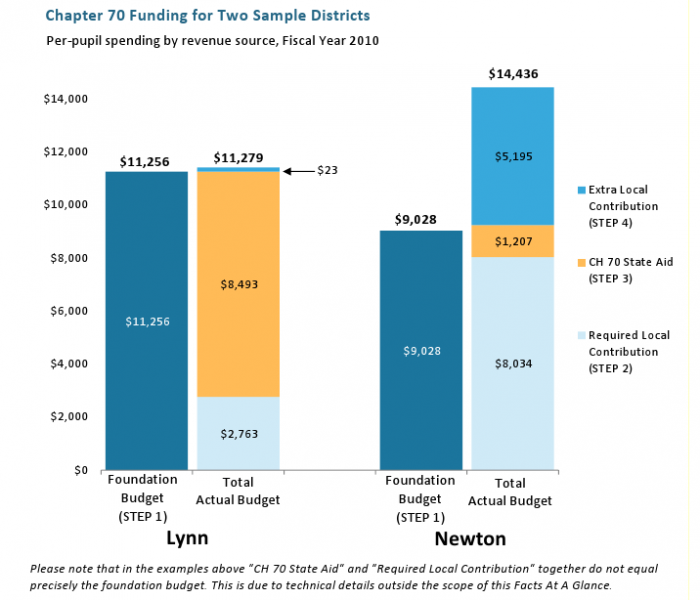

I moved to Massachusetts about 3 years ago. Here, the state goes around and tells each community how much they are required to spend on education, based on local conditions. So Lynn (down on its luck, blue collar city) might be required to spend $12k per pupil and Newton (wealthier city) might be required to spend $10k per pupil. Lynn then says they can't afford to pay anything - they're broke - so the state checks the math and pays something close the full amount. The state then does the math for Newton and gives them whatever the minimum is - say it's $2k. Newton then has to come up with the other $8k themselves. For towns somewhere in the middle they get a middling amount of aid.

Not bad right? Well then Newton decides they can afford more and their babies are worth it and so they double what the state told them they were required to contribute. Then Needham and Wellesley and the other Maplewood-like communities do the same and nobody pays any less in property taxes.

Tah-dah.

PVW said:

If I were dictator of NJ, I'd scrap the property tax and go all in on income-based taxes, and add a lot more brackets at a much higher rate on the high end.

So you'd rather give all the power of the purse to Trenton and just hope they had your best interests at heart? Or are you advocating a municipal income tax? If Camden can't collect property taxes they aren't likely to do much better collecting income taxes.

Not trying to be snarky, I just don't see that as workable.

RobB said: I moved to Massachusetts about 3 years ago. Here, the state goes around and tells each community how much they are required to spend on education, based on local conditions.

I like the idea they use, but apparently it hasn't done much for the state's fiscal health.

Ranking only above NJ and IL in fiscal health isn't anything to write home about.

conandrob240 said:The difference in state income tax is pretty small- 1%? Not a solid explanation, why doesn’t nJ use a different school funding formula? More importantly, why do people defind it like it’s ok?

Because this way, you have local control of the schools and of the schools' funding.

And those who want it changed are not in power to change it. Those who have power to change it like it the way it is.

Amstel said:

I agree with many of your points on the benefits of the fire dept, but I’m struggling to understand what efficiencies are gained through the merger with SO with cost savings NOT being among them. That sounds absurd to me. Volunteer departments do present many challenges, but what did the committee do to get comfortable that the current staffing levels are efficient? How many fires did they respond to last year? How does it compare to other towns with full time staff? Etc. Is it possible to get by with 75% or 50% of the current service level?

It’s all in the report.

As to the CBAC, when I served I recall several members with relevant experience and a large mass of institutional knowledge. As to my own experience, I was quite familiar with the budget, knew who to contact or where to look for those areas I wasn’t fully 100% on, and professionally had worked on corporate budgets of many multiples in size and scope with far more drivers and variables.

DannyArcher said:

PVW said:So you'd rather give all the power of the purse to Trenton and just hope they had your best interests at heart? Or are you advocating a municipal income tax? If Camden can't collect property taxes they aren't likely to do much better collecting income taxes.

If I were dictator of NJ, I'd scrap the property tax and go all in on income-based taxes, and add a lot more brackets at a much higher rate on the high end.

Not trying to be snarky, I just don't see that as workable.

First of all, who is "Trenton?" We are. If they don't have our best interests at heart, that's on us as voters.

Secondly, an implicit point I was making is that municipalities are the wrong scale for this. Commercial activity crosses municipal lines. Employment and business activity does too. Most of life in general does, actually. So yeah, I'd agree that, say, having a municipality raise income taxes won't help much -- it's at the state level I meant. I don't think municipalities should, by and large, by in the taxation business. The bulk of revenue should be raised statewide, and should be aggressively progressive. I want, say, Essex Fells to have no property taxes, but Essex Fells residents to be sending a lot more of their money to the East Orange school district.

Whose best interests should govern in determining the best approach to school funding state-wide? The school districts which receive the highest school aid, often over that to which they are entitled under the present school funding formula, tend to have a larger population (more potential voters) than those school districts which are under-funded. There does not appear to be a sufficient mechanism for adjusting educational funding allocation as demographic factors on which school funding decisions are made change over time. How would best interests help us in South Orange and Maplewood?

PVW said:

First of all, who is "Trenton?" We are. If they don't have our best interests at heart, that's on us as voters.

Trenton has a long history of mis-allocating funds that were supposedly dedicated for specific purposes. I am not comfortable turning over the reigns of the funding of most/all of our local needs to representatives who were not elected to represent the interests of Maplewood.

DannyArcher said:

PVW said:Trenton has a long history of mis-allocating funds that were supposedly dedicated for specific purposes. I am not comfortable turning over the reigns of the funding of most/all of our local needs to representatives who were not elected to represent the interests of Maplewood.

First of all, who is "Trenton?" We are. If they don't have our best interests at heart, that's on us as voters.

But this entire thread demonstrates dissatisfaction with the way we are taxed by our locally elected Township Committee, or actually that said TC has little or no control over how we are taxed and how the money is spent.

The Senator and Assembly persons who represent the residents of this District in Trenton were elected to represent the interests of Maplewood. The entire Legislature as well as the Governor are elected to represent the interests of all residents of the State.

Under the present system no one is fully accountable for the interests of Maplewood. There are two many levels of government and too much fetishizing of "local control".

I agree with PVW

"The Senator and Assembly persons who represent the residents of this District in Trenton were elected to represent the interests of Maplewood."

Not exactly. They were elected to represent the interests of a number of communities which comprise their district. Under a previous district configuration, Maplewood was divided among three different districts, none of which were likely to have representatives giving Maplewood much consideration if other communities in their district had conflicting interests. This arrangement really does not guarantee that the interests of Maplewood are being represented in Trenton.

PVW said:

DannyArcher said:First of all, who is "Trenton?" We are. If they don't have our best interests at heart, that's on us as voters.

PVW said:So you'd rather give all the power of the purse to Trenton and just hope they had your best interests at heart? Or are you advocating a municipal income tax? If Camden can't collect property taxes they aren't likely to do much better collecting income taxes.

If I were dictator of NJ, I'd scrap the property tax and go all in on income-based taxes, and add a lot more brackets at a much higher rate on the high end.

Not trying to be snarky, I just don't see that as workable.

Secondly, an implicit point I was making is that municipalities are the wrong scale for this. Commercial activity crosses municipal lines. Employment and business activity does too. Most of life in general does, actually. So yeah, I'd agree that, say, having a municipality raise income taxes won't help much -- it's at the state level I meant. I don't think municipalities should, by and large, by in the taxation business. The bulk of revenue should be raised statewide, and should be aggressively progressive. I want, say, Essex Fells to have no property taxes, but Essex Fells residents to be sending a lot more of their money to the East Orange school district.

I agree that "Trenton" = "New Jersey."

As much as I like deep structural and interest group explanations for NJ's property tax crisis, ultimately, the fault is ours.

Phil Murphy didn't purport to want to lower NJ's taxes. Whenever he was asked about NJ's taxes his answer was "NJ was never a cheap place, but it was a place where you got a lot for you money and I want to bring that back." He sang paeans every day to public sector unions and openly revelled in public sector union endorsements. He proposed billions in new spending. He wouldn't give an answer regarding what his stance was on extending the police & fire arbitration caps.

An electorate that prioritized lowering NJ's taxes wouldn't have elected Phil Murphy.

I'm pretty sure that I am opposed to most of the kinds of measures that would be required to lower NJ taxes statewide on an overall basis. However, the current system does not share the burden (nor the benefits) equitably statewide and that needs to be rectified.

Sac, I agree, except that I would change the word equally to equitably.

Runner_Guy said:Phil Murphy didn't purport to want to lower NJ's taxes. Whenever he was asked about NJ's taxes his answer was "NJ was never a cheap place, but it was a place where you got a lot for you money and I want to bring that back." He sang paeans every day to public sector unions and openly revelled in public sector union endorsements. He proposed billions in new spending. He wouldn't give an answer regarding what his stance was on extending the police & fire arbitration caps.

An electorate that prioritized lowering NJ's taxes wouldn't have elected Phil Murphy.

Would you take a deal that was revenue-neutral but lowered or eliminated property taxes? IOW, is your complaint about property taxes specifically, or about the amount of taxes overall?

PVW said:

Runner_Guy said:Phil Murphy didn't purport to want to lower NJ's taxes. Whenever he was asked about NJ's taxes his answer was "NJ was never a cheap place, but it was a place where you got a lot for you money and I want to bring that back." He sang paeans every day to public sector unions and openly revelled in public sector union endorsements. He proposed billions in new spending. He wouldn't give an answer regarding what his stance was on extending the police & fire arbitration caps.Would you take a deal that was revenue-neutral but lowered or eliminated property taxes? IOW, is your complaint about property taxes specifically, or about the amount of taxes overall?

An electorate that prioritized lowering NJ's taxes wouldn't have elected Phil Murphy.

I'm a big environmentalist, so I would take a deal that was revenue positive if the increased taxes would encourage conservation and reuse.

Applying the sales tax would bring in at least $700 million a year, tens of millions of which would be from out-of-staters.

Taxes on plastic bags would bring in small, but non-trivial, amounts for NJ. I'd support a cardboard box tax, but I've never read about a place doing that.

For tax relief, I think that direct rebates are better than giving money to localities because localities are likely to spend that money, although the state's most underaided school districts and munis must have more aid.

jimmurphy said:

Sac, I agree, except that I would change the word equally to equitably.

Done! And, yes, that's a much better word to express it!

Runner_Guy said:

PVW said:I'm a big environmentalist, so I would take a deal that was revenue positive if the increased taxes would encourage conservation and reuse.

Runner_Guy said:Phil Murphy didn't purport to want to lower NJ's taxes. Whenever he was asked about NJ's taxes his answer was "NJ was never a cheap place, but it was a place where you got a lot for you money and I want to bring that back." He sang paeans every day to public sector unions and openly revelled in public sector union endorsements. He proposed billions in new spending. He wouldn't give an answer regarding what his stance was on extending the police & fire arbitration caps.Would you take a deal that was revenue-neutral but lowered or eliminated property taxes? IOW, is your complaint about property taxes specifically, or about the amount of taxes overall?

An electorate that prioritized lowering NJ's taxes wouldn't have elected Phil Murphy.

Applying the sales tax would bring in at least $700 million a year, tens of millions of which would be from out-of-staters.

Taxes on plastic bags would bring in small, but non-trivial, amounts for NJ. I'd support a cardboard box tax, but I've never read about a place doing that.

For tax relief, I think that direct rebates are better than giving money to localities because localities are likely to spend that money, although the state's most underaided school districts and munis must have more aid.

Tom_R said:

Which do you perceive to be the most underaided school districts?

TomR

You can assess underaiding by looking at districts' deficits in dollars per student or in what percentage of their recommended aid they receive. My preference is to use deficits in dollars per student.

These are the most underaided districts for 2017-18.

Regarding taxes... you would think that underaided districts would have higher taxes than overaided districts in order to compensate for state aid deficits, but this actually isn't true. If you compare the ~380 underaided districts with the ~200 overaided districts, on average, their taxes are the same as a percentage of Local Fair Share.

It is not until you get to severely underaided districts, where taxes become much higher. Whereas the median district in NJ taxes at 96% of Local Fair Share, the median district with a state aid deficit of $2000 per student or more taxes at 116% of Local Fair Share.

More info is here:

| District | Deficit Per Student |

| ELMWOOD PARK | ($5,578) |

| KEARNY TOWN | ($5,634) |

| HALEDON BORO | ($5,676) |

| CUMBERLAND CO VOCATIONAL | ($5,894) |

| PROSPECT PARK BORO | ($5,902) |

| MANVILLE BORO | ($6,110) |

| GUTTENBERG TOWN | ($6,285) |

| LINDENWOLD BORO | ($6,439) |

| HI NELLA | ($6,481) |

| EAST NEWARK BORO | ($6,960) |

| PASSAIC COUNTY VOCATIONAL | ($7,200) |

| ATLANTIC CO VOCATIONAL | ($7,240) |

| FAIRVIEW BORO | ($7,361) |

| FREEHOLD BORO | ($7,675) |

| ATLANTIC CITY | ($8,216) |

| PASSAIC CO MANCHESTER REG | ($8,586) |

| BOUND BROOK BORO | ($9,546) |

Fully and fairly funding state aid is necessary, but not sufficient, to normalize NJ's property taxes.

For one, BOEs are highly likely to spend much or most of any new state aid they receive. Perhaps in the first year the tax offset would be larger, but having more money available would probably mean larger salary settlements in future contract negotiations.

Two, the amount of money middle-class districts stand to gain is a tiny portion of their all-in taxes.

For 2017-18, the SOMSD received 54% of the money it was supposed to get, but that deficit only equaled $3.9 million. If the SOMSD got 100% of its state aid (highly unlikely) and the BOE decided to use every dollar for tax offsets (even more unlikely), it would reduce our property taxes by under 2%, since SO and Maplewood have a combined ~$200 million county+municipal+school tax levy.

A 2% tax reduction is palpable, but SOMA's taxes would still be above 3% of property value and among the highest in the US in tax and dollars-per-household.

For 2017-18 NJ underfunded school aid by $2 billion and there was a $28 billion total property tax levy. If NJ could (never mind how) increase school aid by $2 billion and BOEs all of that money for tax offsets (which they wouldn't) it would reduce NJ's property taxes by 7%.

Although NJ's property taxes would then become only the country's second worst (after Illinois'), they would still be extreme.

IMO, the spending side is neglected in discussions of why NJ's property taxes are so high and in possible solutions. I don't think that shifting more spending to the state-level has been effective because that state spending supplements, not supplants, local spending.

If the state is going to dictate the curriculum and testing for a "thorough and efficient education" it should provide the funding for that education, raised through the statewide income tax.

Edited to add that the funding should be equal on a per-student basis.

A 2% decrease in what residents have to pay in real property taxes may appear inconsequential to you but we have residents in Maplewood and South Orange who are struggling to be able to continue to afford the taxes here. A two percent reduction in the taxes they they would have to pay could help some of them remain in town longer.

If a 2% gain in State aid were to be added to the budget, it could mean the difference between keeping teachers or programs or cutting them because we can no longer afford to fund them. Applied to preventative maintenance, that 2% additional funding could lead to substantial capital expenditure savings down the road.

Every little bit helps.

Many laughed when we moved to Northern Ca from Maplewood to pay 62,500 in property tax. Though after leaving Maplewood, where we had 3 girls in Private School, we are actually saving 40,000 a year. The point of my remarks is we all know what we walked into and it is imperative that the local realtors give clear information to prospective clients. New Jersey is not built for proper tax relief.

joan_crystal said:

A 2% decrease in what residents have to pay in real property taxes may appear inconsequential to you but we have residents in Maplewood and South Orange who are struggling to be able to continue to afford the taxes here. A two percent reduction in the taxes they they would have to pay could help some of them remain in town longer.

If a 2% gain in State aid were to be added to the budget, it could mean the difference between keeping teachers or programs or cutting them because we can no longer afford to fund them. Applied to preventative maintenance, that 2% additional funding could lead to substantial capital expenditure savings down the road.

Every little bit helps.

I said that getting full state aid would give us "palpable" tax relief, if the BOE were to use the money for tax offsets. As you may know, I've invested a lot of time and effort into NJ making its distribution of state aid fairer and more rational, so this is a cause I take very seriously.

But, as I also said, state aid was "necessary but not sufficient" to produce property tax normality for NJ, since NJ also has to find ways to reduce local government spending. Contrary to what Phil Murphy has said, fully funding SFRA (which he won't be able to do anyway) wouldn't be a "game changer" on property taxes.

For Sale

Garage Sales

-

HUGE Rummage sale to benefit the Bloomfield High School Robotics Team Sale Date: Apr 27, 2024

More info

Featured Events

-

Stephen Whitty Presents - Hometown Movie Stars: The Celebrated Actors Of CHS

May 6, 2024 at 7:00pm

-

'Beethoven's Wrong Note: A Steampunk Opera'

May 12, 2024 at 2:00pm

Our painfully high taxes are directly correlated to others’ ecstatically low taxes. Barring a catastrophic fire that wipes out enough homes to make way for significant commercial eatables, NOTHING will happen to change this in our lifetime.