College Planning Specialist/Accountant or CPA

They look at your income in the year before she applies. If she is applying to start college in 2017, your calendar year 2016 income will be what they look at.

If a college gives out its own grant funds (not federal, but college-specific), you can send a letter asking for "professional judgment." Those are the words to use. So, say, if your income has been $50k every year for the past ten years, then in 2016 it shot up to $100k, you can explain that.

Have you used the net price calculators (NPC)? Every college has one. You can plug in various scenarios to see what each particular college would cost, based on your financial and family circumstances. However, the NPCs are not particularly accurate if you own a business and are not a W-2 employee.

Thanks. But I never said my child was starting college in 2017.

Can anyone suggest someone?

Lucylily186 said:

Thanks. But I never said my child was starting college in 2017.

Can anyone suggest someone?

Sorry . . just trying to help. That was just an example. No matter what year she starts, they will look at your income in the previous year for FAFSA-only schools. For CSS schools, they may look at more. I don't have a professional to suggest, but I do have a lot of experience with this. Plug in the numbers on the NPCs. It's free.

CSS looks at 2 years of data.

Ed Bove is one person who does this work but it may not be necessary.

I think anybody who specializes in this work will be willing to work with you and will likely suggest that no time is too soon. Maybe I'm cynical.

We ran some numbers past our accountant and he gave us some suggestions.

Yes I agree. Ed Bove is on my list. But I need an accountant with college experience etc. to see if a change in structure would even be necessary at this point.

We are using College Benefits Planing Group in Roseland. They are a combination of college financial planners as well as college counselors. The owner is a CPA, Personal Finance specialist. We just started working with them, so I cant say that I highly recommend them, but so far they seem very good. http://cbrg.info/ Good luck.

If you would be comfortable telling us -- or giving us an idea -- what the "change in structure" would be, we might be able to save you a bucket of money. FAFSA is not very complicated. Those who have been through it might easily be able to tell you whether your change in structure will be relevant or not.

Will she be applying to schools that require a CSS? Generally, the most selective schools (with the most financial aid to give) require this extra application. On one hand, there is a little more flexibility for the CSS colleges to use "professional judgment." On the other hand, the CSS schools look very skeptically at applications from families that own a business. They know all the tricks.

Also, as I mentioned above, you can do it yourself using colleges' Net Price Calculators. Every college has one. You can run different scenarios and get the answer yourself. Whatever time you have to spend gathering up numbers to run the NPCs yourself, you'd have to spend that same time gathering the same data for your professional anyway. You might as well plug in the numbers yourself. For free.

Another free idea: go to the financial aid forum on College Confidential: http://talk.collegeconfidential.com/financial-aid-scholarships/

You can post anonymously and within minutes experts will answer your question -- or will tell you that your situation is so extraordinarily complicated that you need to see a professional.

News! I just learned that beginning with the school year beginning Sept 2017, the federal government and the CSS schools will be basing financial aid on what they are calling the "prior-prior year." That means that for the 2017-2018 school year, THIS YEAR'S tax returns -- 2015 -- will be key. I am going to start a new thread.

Yes I am aware of the new changes Shoshannah.

I am looking to have my business become a Subchapter S so that I receive a W2 instead of existing LLC where it is a pass through.

Ed Bove is a nice guy, but he only does personal tax returns and he could not recommend a CPA who handles business related questions.

For FAFSA, the end game is your reported personal income. Will your reported income on your personal tax return be different under the S corp? Clearly I am not an expert on how to move money around in a small business, but I do know that what FAFSA cares about is the income on your 1040. Most experts recommend a C corp so that the business income can be retained in the business, not passed through to you. http://www.wsj.com/articles/a-financial-advisers-plan-to-maximize-college-financial-aid-for-her-clients-1425915278

As for asset determination, neither an S corp nor an LLC is counted as an asset on the FAFSA—as long as it has fewer than 100 employees and is controlled by your family.

http://www.finaid.org/fafsa/smallbusiness.phtml

HOWEVER, the CSS Profile is different. It digs way deeper than the FAFSA and it counts things that FAFSA excludes. For example: Your small business will be counted as an asset on CSS. But you are expected to contribute less of your assets than your income.

https://www.edvisors.com/fafsa/secrets/minimize-impact-of-assets/

Another key thing to remember: Any contributions you make to your retirement plan in a given year will be ADDED BACK into that year's income. You are expected to stop contributing. However, FAFSA does not count the funds already in your retirement plan. For CSS, they do ask how much you have in retirement funds, but I believe it is just to see if you are, for example, reporting an income of $30,000 but you have $5 million in IRAs. CSS gets at every angle.

These sources are extremely helpful and reputable:

http://www.forbes.com/sites/troyonink/2014/11/30/your-llc-s-corp-or-partnership-just-cost-your-kid-100000-in-college-aid/2/

http://www.forbes.com/sites/troyonink/2014/11/28/2015-guide-to-fafsa-css-profile-college-financial-aid-and-expected-family-contribution-efc/

http://www.forbes.com/sites/troyonink/2014/02/14/how-assets-hurt-college-aid-eligibility-on-fafsa-and-css-profile/

https://www.edvisors.com/

http://www.finaid.org/

Also, I cannot stress enough: Do the Net Price Calculator for a few sample colleges. Do one college that uses FAFSA only. Do one college that uses FAFSA and CSS. and Do one that is a member of the 568 Presidents' Group (http://568group.org/).

Featured Events

-

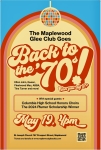

Go "Back to the '70s" with The Maplewood Glee Club and Special Guests from CHS

May 19, 2024 at 4:00pm

For Sale

-

2007 Honda Fit $4,400

More info

Our family income level and/or my current NJ business structure may possibly change in 2016. I would like to talk with someone on seeing the impact this will have on my teen when she applies for college financial aid. (FAFSA)

Any suggestions?

Lucy