Bear Market?

Just wonderful news. So, basically over the past 15 yrs, all the money you socked away in your 401k may as well been under your mattress. If all the gains get completely wiped away every 5 yrs. So much for the theory of it being up in the long-term. Unless you rode the 90s wave, few of us are up or even even right now from 2000 or so. Sigh

conandrob240 said:

Just wonderful news. So, basically over the past 15 yrs, all the money you socked away in your 401k may as well been under your mattress. If all the gains get completely wiped away every 5 yrs. So much for the theory of it being up in the long-term. Unless you rode the 90s wave, few of us are up or even even right now from 2000 or so. Sigh

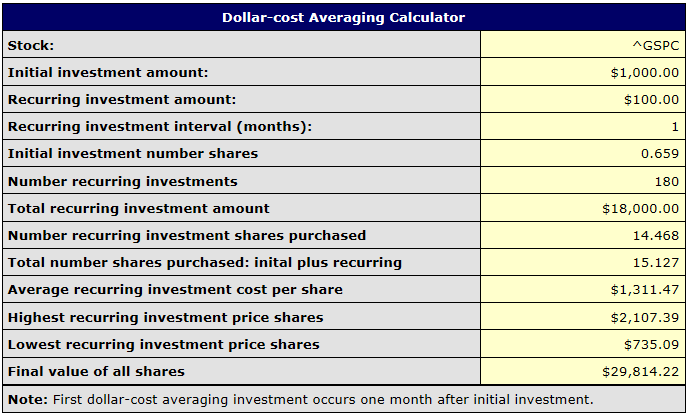

The S&P is up 37% the last 15 years, but it's unlikely you plowed in all your money on August 24, 2000. So if you started with $1000 and added $100 a month for the past 15 years you'd have invested a total of $18,000 with a current value of ~$29,000. That's a 60% gain. Not bad (though, historically speaking, not great either - but better than the mattress).

China markets had a gain of 100%+ last year. Anyone thinking that apple cart wouldn't tip over at some point probably shouldn't be investing in the equity market.

Any chance we can merge these two threads? This one and So whatd'ya think? Up, more down or sideways?

I'm getting sick reading one of them. Two and I am really gonna lose it.

Still up double digits the past year. Crazy. You can almost see the rich shearing the poor.

LL_ said:

Any chance we can merge these two threads? This one and So whatd'ya think? Up, more down or sideways?

I'm getting sick reading one of them. Two and I am really gonna lose it.

LL, it would be fine with me if the threads were merged. I only created this one, because I believed that the title of the other thread didn't reflect the crazy huge downdraft of the market this morning, and a more explicit title would be useful.

@Jasmo, today I think your thread title is best but FOr my own sanity I'm gonna stop reading them both (and STOP clicking on cnn.com)

Dow has recovered 700 since its 1,000 point drop at the opening this morning

CNN Fear & Greed Index, which is a short-term contrarian indicator, is 3, extreme fear. I don't recall ever having seen it that low.

http://money.cnn.com/data/fear-and-greed/

Well, let's say past 13 yrs then. Definitely not 37% at least not my account. Other than what I've added, it's grown very little overall. Maybe 10% total at most in 12 or 13 years. Less than 1 percent a year sucks. May as well have had it in a CD.

And 37% over 15 years isn't much to write home about anyway even if you made perfect investments and saw the whole 37% ( which is highly doubtful). 2% a year sucks too

conandrob240 said:

Well, let's say past 13 yrs then. Definitely not 37% at least not my account. Other than what I've added, it's grown very little overall. Maybe 10% total at most in 12 or 13 years. Less than 1 percent a year sucks. May as well have had it in a CD.

The past 13 years have been fantastic.

Starting with $1000 in August of 2002, adding $100 a month.

Total invested: $15,600

Current value: $45,000

Of course, that assumes you're not trying to outsmart the market.

Link to these stats please? Or are you just bragging about your own portfolio?

My personal experience is not at all that my money has tripled since 9/11. I am not doing anything really risky ( or really safe) either. Fidelity investing mostly in the 2025,2030 hybrid retirement type vehicles. Some individual funds but fairly standard S&P type moderate stuff. It seems like mine goes nowhere. It grow a ton in the early to mid-90s but since then it seems like it's what I'm putting in plus a little bit of warning here and there

Since I'm nowhere near retirement, my whole approach to this kind of news is "la la la la I can't hear you."

conandrob240 said:

Link to these stats please? Or are you just bragging about your own portfolio?

My personal experience is not at all that my money has tripled since 9/11. I am not doing anything really risky ( or really safe) either. Fidelity investing mostly in the 2025,2030 hybrid retirement type vehicles. Some individual funds but fairly standard S&P type moderate stuff. It seems like mine goes nowhere. It grow a ton in the early to mid-90s but since then it seems like it's what I'm putting in plus a little bit of warning here and there

Oops, wrong dates. Trying again. I also used the wrong ticker for the 13 year example. The default is IBM and I kept that I think. It's more like $25k not $45k (obviously....if I'd thought about it).

http://www.buyupside.com/calculators/dollarcostaveinclude.php?symbol=%5EGSPC&amountinitial=1000&amount=100&interval=1&start_month=07&start_year=2000&end_month=07&end_year=2015&submit=Calculate+Results

Crap. I hope this isn't the biggest drop in history, like it's approaching.

Here’s the data to back up RobB’s comment. If you invested $1000 in DIA (an ETF that tries to mimic the Dow) at the opening on August 1, 2002 (63.73 adjusted for dividends and splits) and invested $100/month at the close of the first open market day of the month through the beginning of this month, you would have invested $16,700. As of 3:45pm, DIA was at about 160. Your total investment would be worth about $28,500, or an increase of (28500-16700)/16700 or about 70%. Keep in mind this is not really 70% over 13 years because you did not invest all of the $16,700 13 years ago.

I did the above by going to Yahoo and downloading the historical price for DIA on a monthly basis, and used the adjusted close numbers. I started with $1,000 worth of DIA at the closing price on July 31, 2002 and purchased $100 worth of shares at the adjusted closing price on the first day of each month.

max_weisenfeld said:

It's not even close to 70%, but it is still sound advice.

Well, it is close to 70% as your total return. The annualized return is about 7.25%

Okay. Well, $29000 is a far cry from $45000 but even that definitely feels like a heck of a lot better than what I am seeing. Part of the problem may be that my money was in there pre-9/11 and lived through the last crash where years of gains were wiped out. Sort of like what happened today ( mini-version). At 7% a year ( which still seems unlikely for most people investing a bit a safer than following the DOW), a huge crash or drop wipes out 5 yrs of gains almost meaning you are a starting all over again every few years.

It's most depressing when I look at my nephews college fund I started for him exactly 13 yrs ago. Balance is around $25,000 but the total gain is around $1500 ( even less today).That's in a balanced type mutual fund. Sucks.

The S&P 500 average return for the past 10 years is 7.15%. Getting a return like that over time is fine by me. I don't need home runs for my core holdings. Singles and doubles are fine.

http://quicktake.morningstar.com/index/IndexCharts.aspx?Symbol=SPX

unicorn33 said:

The S&P 500 average return for the past 10 years is 7.15%. Getting a return like that over time is fine by me. I don't need home runs for my core holdings. Singles and doubles are fine.

http://quicktake.morningstar.com/index/IndexCharts.aspx?Symbol=SPX

See,that's theproblem, though. Most people don't really notice the 7% growth and look for the home runs. And end up striking out more often.

Sponsored Business

Promote your business here - Businesses get highlighted throughout the site and you can add a deal.

After a huge tumble of over 8% overnight in China, there is increasing pressure on the world and US stock markets this morning, quickly escalating in the last few hours. Buckle your seat belts.

ETA, as Cramer points out today, 10/2, an unexpected loss of jobs in the last month is against expectations and may reinforce the recent weakness in the stock market.